“We spend money we don’t have

To buy things we don’t need

To impress people we don’t like.”

Grandma White

If you’re like me, you probably grew up in a home where “financial literacy” is a foreign language.

Growing up, I witnessed my parents drown in debt. To be fair to them, they borrowed money for our sake—to send me and my siblings to better schools so we could have a great future (along with some wrong financial decisions).

I can clearly remember my parents fighting because of money. Whenever debt collectors came to our home, my parents often hid and we’d tell the debt collectors they were away. As a child, I felt horrible. I knew at that time I didn’t want to get into debt.

Fast-forward to my 20s, I committed a lot of financial mistakes without even knowing it. As I started earning, I splurged on things recklessly. I often dined out with friends and spent money impulsively. I did not track my expenses. I did not save. I would always end up short on cash, waiting for the next paycheck to come. It was another horrible feeling.

By some stroke of bad luck, I was suddenly without a job. I decided to take a career break. The office politics, my demotivating job, and the meager salary took a toll on my emotional well-being. And I needed a retreat from all the brutal realities in the workplace… in life.

The beginning of a journey…

It was during this time that I stumbled across Dani Johnson’s Youtube channel and seriously pondered the term “financial literacy.” It opened a whole new world to me. For months, I devoured one resource after another just to learn how to earn more money.

At that time, I began to understand my financial mistakes. I didn’t know how to properly manage my personal finance, which led to poor decisions. I knew it was time for my life to change its course.

BUT CHANGING WASN’T EASY. Breaking unproductive mindsets that have been cemented into my subconscious for years and years was tough. As they say, bad habits die hard — I didn’t realize the gravity of this quote till then.

“We were not taught financial literacy in school. It takes a lot of work to change your thinking and to become financially literate.”

-Robert Kiyosaki-

The mistakes continue…

When I found another job, I went back to my old habits. My mindset has slightly shifted, but I was still spending my money carelessly. While I was beginning to create a monthly budget, I still wasn’t able to save anything.

When I got out of yet another job, I’m left without any contingency funds. I didn’t have any financial sources for several months. Once again, I became a financial burden to my family. It was during this time that I decided to be serious about financial freedom.

Finally, a book…

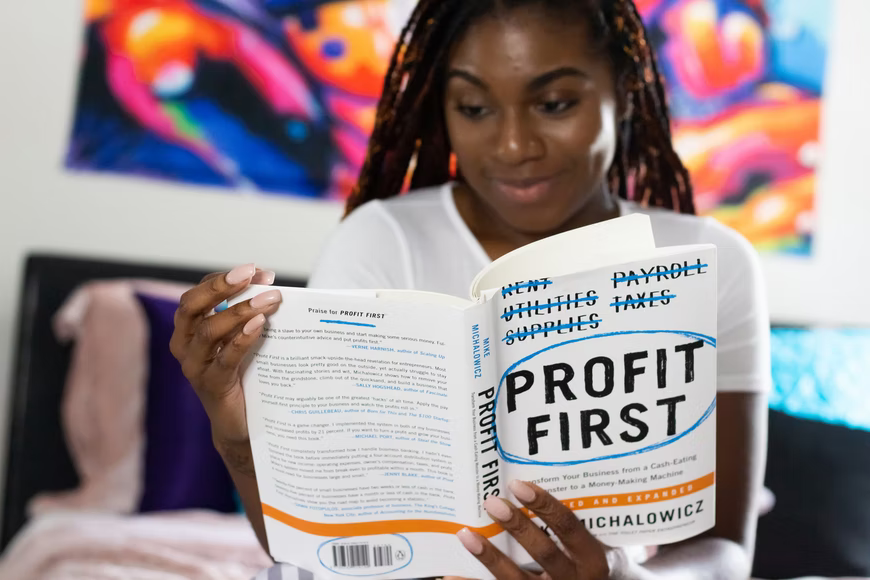

Then I finally found the book “Rich Dad, Poor Dad” by Robert Kiyosaki. The path toward financial literacy became much clearer and more concrete to me. I decided to be more intentional in my financial journey.

Sure, I still commit multiple mistakes, but being aware of these negative habits helped me understand my financial tendencies, improve my decision-making, identify my financial goals, and create a financial strategy.

How to start your own financial journey…

If you were like me and are at your financial crossroads, the path to financial freedom can be overwhelming, challenging, and exhausting. But there’s peace in knowing we have a way out of our dire circumstances.

To help you in your financial limbo, here are some steps that guided me as I started this journey to success:

1. Have self-awareness

Every change starts with the awareness of an existing problem. If you’re not aware of the areas that need help in your finances (and life in general), starting this journey may demotivate you early on.

2. Find financial mentors that resonate with your financial values

As Dani Johnson would say, you don’t want to learn about financial management and wealth from your broke uncle or friend who can’t even make ends meet. Don’t get me wrong, as much as they have the best intentions in giving their personal views, getting financial advice from someone without visible results is a recipe for financial disaster.

3. Identify your financial goals

So you want to be financially free—that’s already a goal! But why do you want to be financially free? What are the things that you’re running away from? How can financial literacy help you achieve the life you want? These are just some of the questions I answered as I started my financial literacy journey.

4. Create your own financial strategy

Once you’ve identified your financial goals, it’s time to determine how you can achieve these goals. Do you need to save? Take in more jobs? Look for another job? Invest in stocks and funds? Build your own business empire? You can scavenge a plethora of resources—books, vlogs, blogs, podcasts, advisers, successful people, Professor Internet—and create an effective and realistic strategy for your financial freedom.

5. Be accountable

Growing up, I blamed my parents for why we were not as comfortable as others were. When I entered the workforce, I blamed my parents for the job opportunities I didn’t have. When I began my financial journey, I blamed my parents for not teaching me about financial literacy early in life. But I never took accountability for the things that I could have done to change my circumstances—and this hindered my personal and financial growth.

We couldn’t change our past and the people around us. But once we start taking accountability and fixing our negative attitudes, we can start making our lives better and create a happier environment for our loved ones.